According to the American Psychological Association’s annual Stress in America™ survey, 62% of Americans list money as their most common source of stress.

If you fall into this category, there are several ways to create financial security and ease the stress on your mind.

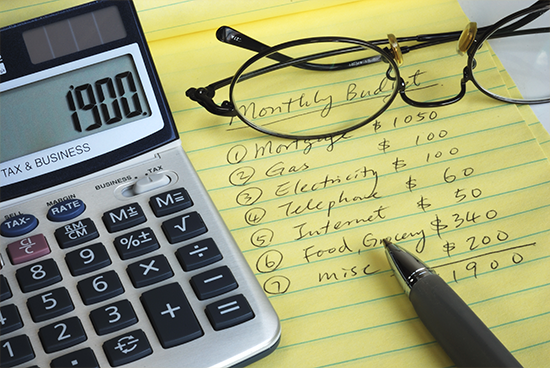

First and foremost: create a budget.

To keep from getting overwhelmed about your financial situation, know where your money goes. Creating and following a budget is first and easiest line of defense against overspending. Track where all of your money goes and makes sure you have enough left at the end of the month to cover your bills. This is the roadmap that guides your spending habits.

To keep from getting overwhelmed about your financial situation, know where your money goes. Creating and following a budget is first and easiest line of defense against overspending. Track where all of your money goes and makes sure you have enough left at the end of the month to cover your bills. This is the roadmap that guides your spending habits.

To do this, track everything you spend on a monthly basis, add in yearly expenses (and divide by 12), then make sure what you plan to spend each month is not greater than the income you have coming to you. If your outgo exceeds your income, you need to make some adjustments to make your numbers meet and avoid going over your budget. Review your budget regularly and account for any changes in your spending or income.

Live below your means.

Just because you can budget and pay for an expensive car, doesn’t mean you should. No matter how much care you take in crafting a budget down to your last penny, surprise expenses will always crop up: your pet needs a trip to the vet, the dishwasher springs a leak, etc.

There are lots of ways to live a life that allows you to leave a little extra leftover for unplanned expenses. Downsize your home or car, cut back your phone or cable plan, cook meals at home instead of going out, from big savings to little, the options are endless. Living a more simple life can go a long way in saving you money.

The value of living below your means when an unexpected expense pops up there will be no stress about making ends meet. More importantly, if all is calm on the expenses front and a sudden opportunity for travel or a unique experience pops up, living below your means may give you the financial ability to say yes!

Create an emergency fund.

By living below your means you have created some leftover cash for small unexpected expenses but what about large, unexpected life changes like an injury, major home repair or job loss.

For this, there is one more line item you need to add into your budget: savings. Always have an emergency fund of 3 to 6 months of living expenses. It sounds like a lot but the sense of peace it creates is priceless. If something big comes up, you will be able to handle it without drama or stress.

Most people cannot save up 3 months of expenses in one paycheck but if you continue to salt a little away each month, you will eventually build up a sizable emergency fund. The key is not to touch it unless there is an actual emergency.

Pay down debt.

If you have gone a long time without enacting any of these strategies you may have been overspending and have some accumulated debt laying around.

Taking steps to reduce your debt can improve the amount of stress in your life. Make it your goal and put a plan (aka your budgeting roadmap) in place to make progress to reducing your debt.

Like any goal – creating a visual around it can make it more real. Maybe post a paper with the amount you need to pay down your debt and update it every time you make a payment. Seeing the balance drop can be very motivating and keep you going when it gets difficult.

Bonus: as your budget allows you to pay your bills on time and your debt goes down, your credit rating will go up (another thing you can visually track) which will save you money in lower interest rates over your lifetime.

Never underestimate the power of a great credit score!

In conclusion . . .

At lot of financial stress relief hinges around your ability to budget.

The big goal here is finding your perfect balance. Very strict budgeting with no room for a little bit of fun can stress you out more than your mounting debt. At the same time, you have to be honest about things you need versus things you want (and are budgeting for as necessities).

Find a budget you can live with that allows you to pay down debt and save money for both little and big emergencies and live with less stress (and more health) in your life.

Great advice…Everything in America is measured in dollars.

Great advice!

Be accountable on your spending

Great advise. Trying to do most of these!

Good advice

I impulse browse a lot.. see something I like I walk around in the store for hours on end with it in hand and then try it on. I always say is this a Want or a Necessity its a tug of war of the Female will haha.

Great information! Love the Emergency Fund in addition to Savings – not the same fund!

reply

agree

I think this is a wonderful article to put on a “healthy living” site. Like the article said, money is the main source of stress in our lives and I, for sure, count myself in that statistic. I find stress relief one of my primary goals for healthy living. Again, great article!

I wish we could have taken classes in school about financials and how to do all of these things.

Finding that “perfect balance” in your finance can make your life less stressful!

“Living a more simple life can go a long way in saving you money”

So true.

Make and follow your budget. It is a stress reliever.

Paying off a debt is the best feeling.

good info!

Great information!!!

Thanks Marice!

Thank you, great advice.

Starting this plan TODAY!!

Nice Amanda. Financial fitness counts too. Go get it.

planning a better budget for each week to follow. using the advice given in the article above. thank you

Love this info. Thank you

Great Advice!!